|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

How Do I File for Bankruptcy in Louisiana: A Comprehensive Guide

Filing for bankruptcy can be a daunting process, especially in Louisiana where state laws add an additional layer of complexity. This guide will help you navigate through the essential steps and considerations.

Understanding Bankruptcy Options

Chapter 7 Bankruptcy

Chapter 7, also known as liquidation bankruptcy, involves the sale of a debtor's non-exempt assets to pay off creditors. It is typically suited for individuals with limited income.

Chapter 13 Bankruptcy

Chapter 13 allows individuals to restructure their debts and create a repayment plan over three to five years. This option is ideal for those with a steady income.

Steps to File for Bankruptcy

Gather Necessary Documents

- Income statements

- Tax returns

- List of debts and creditors

- Property and asset documentation

Complete Credit Counseling

Before filing, you must complete a credit counseling course from an approved provider. This is a mandatory step in Louisiana.

File the Petition

Submit your bankruptcy petition, along with all required forms and schedules, to the Louisiana bankruptcy court. Ensure accuracy to avoid delays.

Attend the 341 Meeting

At this meeting, creditors and the trustee can question you about your financial situation. This is a crucial part of the process.

Life After Bankruptcy

Post-bankruptcy, it is important to rebuild your financial life. Consider consulting with financial advisors or florida bankruptcy attorney for guidance on improving your credit score and financial habits.

Frequently Asked Questions

What are the costs associated with filing for bankruptcy in Louisiana?

Filing fees for Chapter 7 are approximately $335, while Chapter 13 fees are around $310. Additional costs may include attorney fees and credit counseling charges.

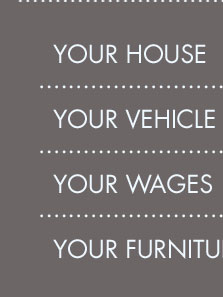

Can I keep my house and car after filing for bankruptcy?

In many cases, debtors can retain their home and car, especially under Chapter 13. State exemptions may protect some equity, but it's crucial to understand specific rules or consult with florida bankruptcy lawyers for detailed advice.

How does bankruptcy affect my credit score?

Bankruptcy can significantly impact your credit score, staying on your report for up to 10 years. However, with careful financial management, you can rebuild your credit over time.

eSR is an online tool to help individuals complete a chapter 7 or chapter 13 bankruptcy petition when they have decided to file bankruptcy without an attorney.

We provide helpful tips and resources to help you file Chapter 7 bankruptcy in your state without a lawyer.

From the immediate relief it offers to the potential long-lasting effects on credit reports, it's a path filled with both pros and cons.

![]()